美聯儲主席耶倫表明快加息 等待太久有危險

美聯儲主席耶倫在國會聯合經濟委員會聽證的演講稿出爐,CNBC稱耶倫就加息給出了目前最為鷹派的言論。

耶倫認為,如果未來的數據進一步表明更加靠近美聯儲的目標,這樣的一次加息可能很快會變成合適的(耶倫原文為:At our meeting earlier this month, the Committee judged that the case for an increase in the target range had continued to strengthen and thatsuch an increase could well become appropriate relatively soon if incoming data provide some further evidence of continued progress toward the Committee's objectives.),等待太久可能會導致美聯儲日後不得不過快作出改變。維持利率不變過久可能刺激過度的風險偏好。

(注:此前表述“相對快的加息是合適”易引發歧義,現已修正為“這樣的一次加息很快會變成合適的”)

耶倫稱,如果美聯儲延遲過久加息,最後的結果可能會是日後不得不突然收緊政策,以使經濟符合美聯儲的長期目標。

耶倫表示,美國經濟朝向美聯儲目標更進一步。隨著勞動力市場改善,通脹率將向2%攀升。美國經濟增速已經從先前受抑制的狀態中有所抬頭。不過,消費者支出溫和,商業投資疲軟。

不過,如往常一樣,耶倫再度強調了將逐步採取行動。未來落後于收益率曲線的風險不大,逐步加息對於未來數年保持中性貨幣立場應該是有效的。

針對就業問題,耶倫稱,近期薪資增速有上升跡象,勞動力市場可能還有一些增長的空間。穩定的失業率令經濟有更多空間運作。少數群體失業率偏高令人困擾。

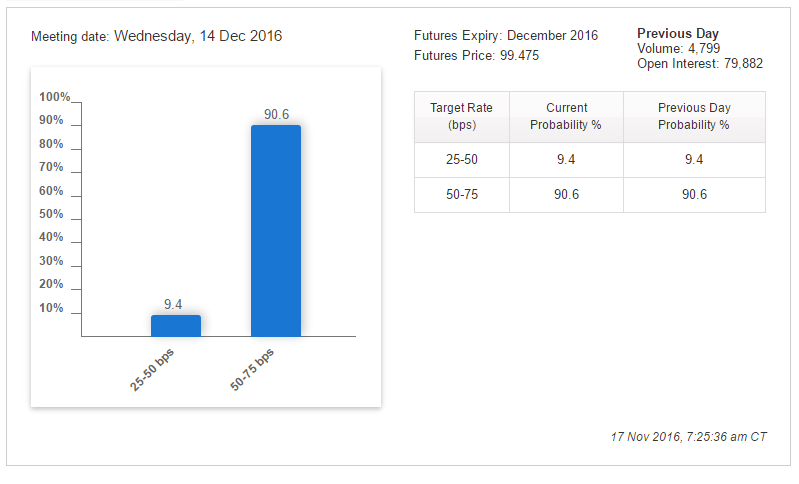

市場一度猜測特朗普當選會否延遲美聯儲加息進程,耶倫的演講稿並沒有講述這個問題。不過,就聯邦基金期貨利率來看,目前市場高度認為美聯儲12月將加息。

聯邦基金期貨利率顯示,市場目前認為美聯儲12月加息的概率高達90.6%。

耶倫將在北京時間23:00正式作證詞並回答提問。

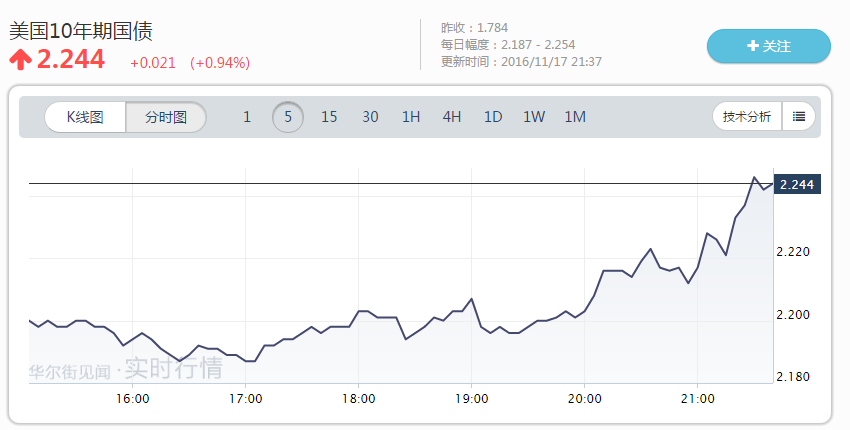

美聯儲主席耶倫證詞公布后,美股期貨維持基本不變,美債價格小幅下跌,美元指數上揚。

以下是英文演講稿:

ChairJanet L. Yellen

The Economic Outlook

Before the Joint Economic Committee, U.S. Congress, Washington, D.C.

November17,2016

Chairman Coats, Ranking Member Maloney, and members of the Committee, I appreciate the opportunity to testify before you today. I will discuss the current economic outlook and monetary policy.

The Economic Outlook

The U.S. economy has made further progress this year toward the Federal Reserve's dual-mandate objectives of maximum employment and price stability. Job gains averaged180,000 per month from January through October, a somewhat slower pace than last year but still well above estimates of the pace necessary to absorb new entrants to the labor force. The unemployment rate, which stood at4.9 percent in October, has held relatively steady since the beginning of the year. The stability of the unemployment rate, combined with above-trend job growth, suggests that the U.S. economy has had a bit more"room to run" than anticipated earlier. This favorable outcome has been reflected in the labor force participation rate, which has been about unchanged this year, on net, despite an underlying downward trend stemming from the aging of the U.S. population. While above-trend growth of the labor force and employment cannot continue indefinitely, there nonetheless appears to be scope for some further improvement in the labor market. The unemployment rate is still a little above the median of Federal Open Market Committee(FOMC) participants' estimates of its longer-run level, and involuntary part-time employment remains elevated relative to historical norms. Further employment gains may well help support labor force participation as well as wage gains; indeed, there are some signs that the pace of wage growth has stepped up recently. While the improvements in the labor market over the past year have been widespread across racial and ethnic groups, it is troubling that unemployment rates for African Americans and Hispanics remain higher than for the nation overall, and that the annual income of the median African American household and the median Hispanic household is still well below the median income of other U.S. households.

Meanwhile, U.S. economic growth appears to have picked up from its subdued pace earlier this year. After rising at an annual rate of just1 percent in the first half of this year, inflation-adjusted gross domestic product is estimated to have increased nearly3 percent in the third quarter. In part, the pickup reflected some rebuilding of inventories and a surge in soybean exports. In addition, consumer spending has continued to post moderate gains, supported by solid growth in real disposable income, upbeat consumer confidence, low borrowing rates, and the ongoing effects of earlier increases in household wealth. By contrast, business investment has remained relatively soft, in part because of the drag on outlays for drilling and mining structures that has resulted from earlier declines in oil prices. Manufacturing output continues to be restrained by the weakness in economic growth abroad and by the appreciation in the U.S. dollar over the past two years. And while new housing construction has been subdued in recent quarters despite rising prices, the underlying fundamentals–including a lean stock of homes for sale, an improving labor market, and the low level of mortgage rates–are favorable for a pickup.

Turning to inflation, overall consumer prices, as measured by the price index for personal consumption expenditures, increased1-1/4 percent over the12 months ending in September, a somewhat higher pace than earlier this year but still below the FOMC's2 percent objective. Much of this shortfall continues to reflect earlier declines in energy prices and in prices of non-energy imports. Core inflation, which excludes the more volatile energy and food prices and tends to be a better indicator of future overall inflation, has been running closer to1-3/4 percent.

With regard to the outlook, I expect economic growth to continue at a moderate pace sufficient to generate some further strengthening in labor market conditions and a return of inflation to the Committee's2 percent objective over the next couple of years. This judgment reflects my view that monetary policy remains moderately accommodative and that ongoing job gains, along with low oil prices, should continue to support household purchasing power and therefore consumer spending. In addition, global economic growth should firm, supported by accommodative monetary policies abroad. As the labor market strengthens further and the transitory influences holding down inflation fade, I expect inflation to rise to2 percent.

Monetary Policy

I will turn now to the implications of recent economic developments and the economic outlook for monetary policy. The stance of monetary policy has supported improvement in the labor market this year, along with a return of inflation toward the FOMC's2 percent objective. In September, the Committee decided to maintain the target range for the federal funds rate at1/4 to1/2 percent and stated that, while the case for an increase in the target range had strengthened, it would, for the time being, wait for further evidence of continued progress toward its objectives.

At our meeting earlier this month, the Committee judged that the case for an increase in the target range had continued to strengthen and that such an increase could well become appropriate relatively soon if incoming data provide some further evidence of continued progress toward the Committee's objectives. This judgment recognized that progress in the labor market has continued and that economic activity has picked up from the modest pace seen in the first half of this year. And inflation, while still below the Committee's2 percent objective, has increased somewhat since earlier this year. Furthermore, the Committee judged that near-term risks to the outlook were roughly balanced.

Waiting for further evidence does not reflect a lack of confidence in the economy. Rather, with the unemployment rate remaining steady this year despite above-trend job gains, and with inflation continuing to run below its target, the Committee judged that there was somewhat more room for the labor market to improve on a sustainable basis than the Committee had anticipated at the beginning of the year. Nonetheless, the Committee must remain forward looking in setting monetary policy. Were the FOMC to delay increases in the federal funds rate for too long, it could end up having to tighten policy relatively abruptly to keep the economy from significantly overshooting both of the Committee's longer-run policy goals. Moreover, holding the federal funds rate at its current level for too long could also encourage excessive risk-taking and ultimately undermine financial stability.

The FOMC continues to expect that the evolution of the economy will warrant only gradual increases in the federal funds rate over time to achieve and maintain maximum employment and price stability. This assessment is based on the view that the neutral federal funds rate–meaning the rate that is neither expansionary nor contractionary and keeps the economy operating on an even keel–appears to be currently quite low by historical standards. Consistent with this view, growth in aggregate spending has been moderate in recent years despite support from the low level of the federal funds rate and the Federal Reserve's large holdings of longer-term securities. With the federal funds rate currently owhich has been about unchanged tthe neutral rate, the stance of monetary policy is likely moderately accommodative, which is appropriate to foster further progress toward the FOMC's objectives. But because monetary policy is only moderately accommodative, the risk of falling behind the curve in the near future appears limited, and gradual increases in the federal funds rate will likely be sufficient to get to a neutral policy stance over the next few years.

Of course, the economic outlook is inherently uncertain, and, as always, the appropriate path for the federal funds rate will change in response to changes to the outlook and associated risks.

Thank you. I would be pleased to answer your questions.

來源:華爾街見聞 轉載請註明作者、出處並保持完整。